European banking credit: financially sound?

By Marc Rovers , Lan Wu

We review the European credit universe and ask why is it that financial credit spreads are so tight relative to non-financials?

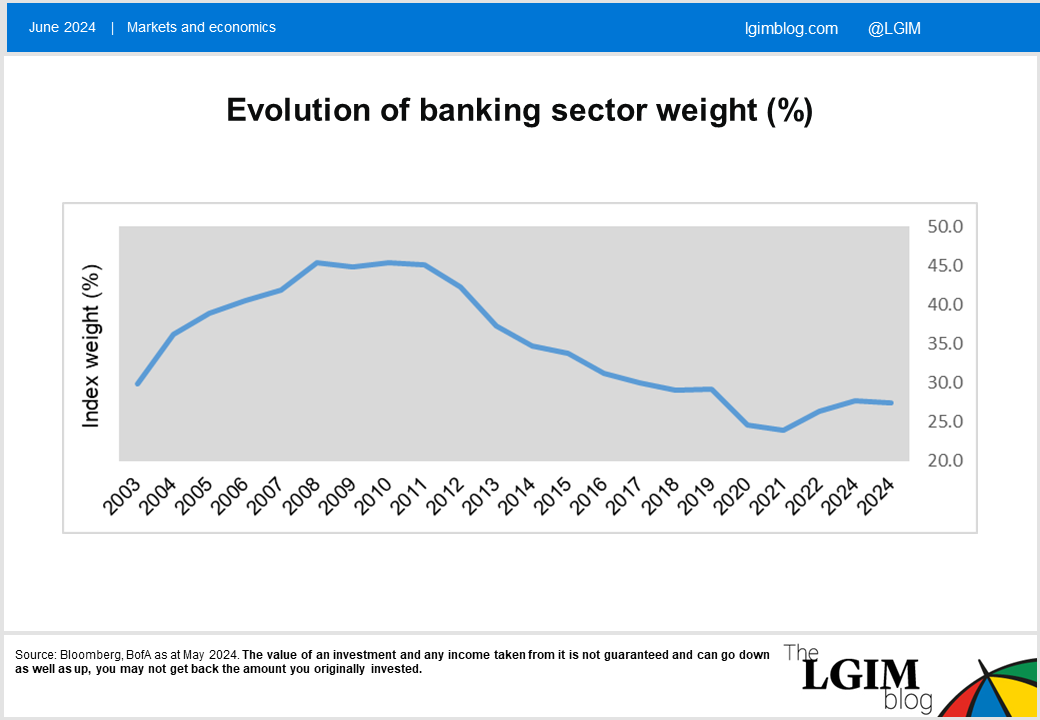

No investor can study the credit universe without paying close attention to the financial sector – and more specifically – banks. While their importance as an overall percentage of the European corporate bond index has fluctuated over the years, banks continue to be the largest sector in the index. Standing at 30% currently[1], the banking sector is still some way off its 2010 peak of around 45% as other constituents of the index have grown, most notably real estate and healthcare. Potential reasons behind an increase in these sector weightings are discussed in an earlier blog.

Banking fundamentals are currently strong. A rebound in profitability from the days of the low (and negative) interest rate environment, driven by higher rates (and a subsequent increase in net interest margins for banks) has been one factor. Repaired balance sheets and positive momentum in credit rating upgrades are often cited as others.

Quality will out?

That said, the banking sector is not a homogeneous unit. Quality varies greatly, and so it’s important to be selective. The favourable macroeconomic backdrop has been a powerful tailwind for banks, both large and small. But, we believe, the credit of regional banks has risen to a point where valuations are increasingly rich relative to their fundamentals. That said, we think M&A opportunities still exist in the sector following the strong share price performance of some acquiring banks.

On the whole, we prefer well-diversified and well-capitalised first tier banks. Geographically, we favour Italian and Spanish banks, some of which have been the subject of credit rating upgrades. Relative to their German counterparts, they also typically hold a much lower percentage of commercial real estate debt[2].

Where do we stand?

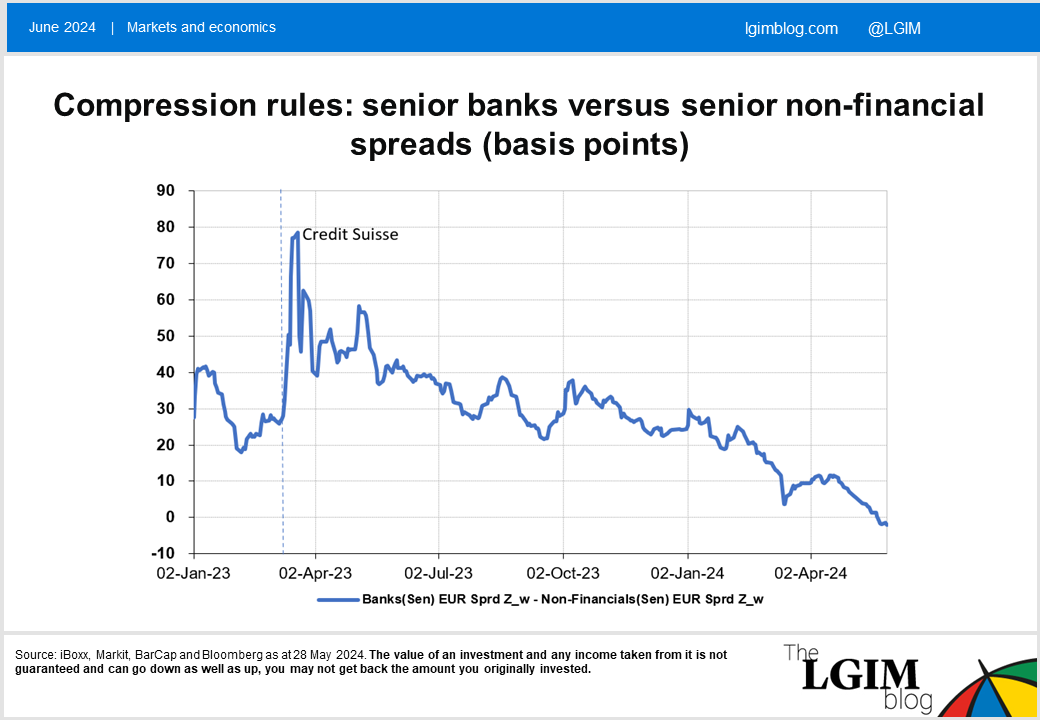

Despite the strong rally seen in bank credit, we remain comfortable with our holdings but prefer to focus on quality names within the sector. Overall, we have reduced our overweight position to neutral at the time of writing[3], as a result of our belief that the spread compression of financials relative to non-financials has provided an opportunity to take profits. The health of banks, almost 15 months on from the mini-banking crisis and the fall of Credit Suisse*, reinforces our long-held belief that the fall of Credit Suisse* was more of an idiosyncratic event rather than the beginning of a systemic one.

Implications for investors

As investors, we always look for potential risks. Banks, as we know, are highly correlated to interest rates and changes in the macroeconomic environment. These could come in the form of lower European interest rates which will inevitably impact banking profitability. If Europe starts to go into a deep recession that further begs the question: have we reached peak bank profitability?

From a bottom-up perspective, a most recent feature of the sector has been the increase in M&A activity, such as BBVA’s* proposed bid for Banco Sabadell*. While we believe there is continued scope for synergies and consolidation, our view is that cross-border M&A will likely remain difficult.

*For illustrative purposes only. Reference to a particular security is on a historic basis and does not mean that the security is currently held or will be held within an LGIM portfolio. The above information does not constitute a recommendation to buy or sell any security.

[1] Source: Bloomberg as at 29 May 2024.

[2] Source: EBA, Reuters as at 11 March 2024.

[3] June 2024.

2024 private credit outlook: A question of balance

By Lushan Sun, Private Credit Research Manager at LGIM Real Assets

Private credit performed well in 2023, with low default rates and plenty of market activity. But, with a recession potentially on the way, will this continue into 2024?

Contact us

For further information about LGIM, please visit lgim.com or contact your usual LGIM representative

Key risks

The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested.

Important information

The views expressed in this document are those of Legal & General Investment Management Limited and/or its affiliates (‘Legal & General’, ‘we’ or ‘us’) as at the date of publication. This document is for information purposes only and we are not soliciting any action based on it. The information above discusses general economic, market or political issues and/or industry or sector trends. It does not constitute research or investment, legal or tax advice. It is not an offer or recommendation or advertisement to buy or sell securities or pursue a particular investment strategy.

No party shall have any right of action against Legal & General in relation to the accuracy or completeness of the information contained in this document. The information is believed to be correct as at the date of publication, but no assurance can be given that this document is complete or accurate in the light of information that may become available after its publication. We are under no obligation to update or amend the information in this document. Where this document contains third party information, the accuracy and completeness of such information cannot be guaranteed and we accept no responsibility or liability in respect of such information.

This document may not be reproduced in whole or in part or distributed to third parties without our prior written permission. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation.

© 2023 Legal & General Investment Management Limited, authorised and regulated by the Financial Conduct Authority, No. 119272. Registered in England and Wales No. 02091894 with registered office at One Coleman Street, London, EC2R 5AA

In Asia this material is issued by LGIM Asia Ltd, a Licensed Corporation (CE Number: BBB488) regulated by the Hong Kong Securities and Futures Commission (“SFC”). This material has not been reviewed by the SFC and is provided to you on the basis that you are a Professional Investor as defined in the Securities and Futures Ordinance (Cap.571) (the “Ordinance”) and subsidiary legislation. By accepting this material you acknowledge and agree that this material is provided for your use only and that you will not distribute or otherwise make this material available to a person who is not a Professional Investor as defined in the Ordinance.