Yield Advantage

04/06/2024 Richard Clarida, Andrew Balls, Daniel J. Ivascyn

The post-pandemic inflation shock and rate-hiking cycle produced a generational reset higher in bond yields, creating a compelling multiyear outlook for fixed income as inflation recedes and risks build in other markets.

The global economy continues to recover from pandemic aftershocks, including trade dislocations, outsize monetary and fiscal interventions, a prolonged inflation surge, and bouts of severe financial market volatility. At PIMCO’s 2024 Secular Forum, we explored how the aftereffects of those disruptions are producing some unexpectedly positive developments while also introducing longer-term risks.

Among the positives, disinflation has occurred more rapidly than anticipated in most developed market (DM) economies. Moreover, macroeconomic and inflation risks look more balanced than they did at our prior Secular Forum a year ago. Central banks are also poised to pivot toward rate cuts, likely on different schedules.

However, we see three main areas where investors have benefited but may be overlooking risks that could develop over our five-year secular horizon:

- Large-scale fiscal stimulus has fueled recent standout U.S. growth, but that exceptionalism has come at a cost: The U.S. is on an unsustainable debt trajectory that the government will ultimately need to address. Meanwhile, financial markets may increasingly need to operate without expectation of government support.

- Artificial intelligence (AI) is poised to realign labor markets and boost productivity, but significant economic impacts may take years. Massive capital investment has accompanied rapid stock market gains in ways reminiscent of past tech booms.

- Asset valuations in some markets offer investors little apparent cushion. This includes equities, where valuations appear stretched, and lower-rated corporate direct lending markets that are less liquid and more exposed to floating interest rates.

For investors, the early 2020s inflation shock and steep policy rate hikes produced a generational reset higher in bond yields, which now embed significant inflation-adjusted cushion. Starting yields are highly correlated with five-year forward returns. That supports an attractive long-term outlook for fixed income returns as inflation recedes, particularly on a risk-adjusted basis relative to other assets. Opportunities across global bond markets also appear uncommonly attractive and diverse, with active country and security selection being key.

We believe this secular backdrop merits a rethinking – and even a reversal – of the traditional 60% stocks / 40% bonds asset allocation paradigm.

As banks retreat from certain markets, we also see attractive opportunities in asset-based lending, particularly consumer-related areas given the strength of the U.S. consumer. We expect bank disintermediation and capital needs will create opportunities in commercial real estate (CRE) debt.

Our Secular Forum sessions explored how the U.S. and China are leading a shift toward a multipolar world order that is likely to alter market and policy dynamics. The peace dividend that countries enjoyed in recent decades is turning into a conflict expense that could be a disruptive force.

Secular theme: Balanced risks, but beware golden ages

Our 2023 Secular thesis, “The Aftershock Economy,” argued that the early 2020s disruptions would create an enduring new reality. We saw a world of elevated macroeconomic volatility and sluggish growth. We predicted that central banks would do whatever it takes to return inflation to “2-point-something” percent.

While this thesis broadly continues to hold, our outlook for the next five years must incorporate and assess major developments since our May 2023 forum:

- A war breaking out in the Middle East and a war in Europe dragging into its third year

- Rapid and – so far – painless disinflation to “2-point-something” percent in most DM economies

- Material divergence of inflation and growth trajectories between the U.S. and other DM economies

- An unforeseen doubling of the U.S. budget deficit in an economy with near record low unemployment

- An October “Treasury tantrum” triggered by worries that the unsustainable U.S. fiscal trajectory will worsen in the years ahead

- Continued bank retrenchment amid tightening regulations for capital and liquidity

Our secular views also build upon our latest Cyclical Outlook, “Diverging Markets, Diversified Portfolios.” That outlook sees central banks breaking ranks to follow varied rate-cutting paths, with relative U.S. strength persisting while many large DM economies slow. That has produced a “re-risking” theme in U.S. financial markets, as well as questions about whether these trends are short-term or more enduring.

Central banks have maintained flexibility …

The sharp post-pandemic cyclical adjustments that rippled through the global economy are now giving way to more lasting secular trends and with important implications. While we continue to expect sluggish global growth and more volatile business cycles over our secular horizon, the risks around that outlook appear better balanced than they did a year ago.

That’s partly due to the quick return of inflation in most advanced economies to “2-point-something” percent levels. Rapid policy tightening brought the inflation spike under control and did so without medium-term inflation expectations rising.

The better balance of risks is also due to central banks’ tacit adoption of an “opportunistic disinflation” strategy to navigate the remaining journey toward target levels. This strategy allows policymakers some leeway to lower rates to support growth at times when inflation appears subdued.

Concerns we had last year about tight monetary conditions triggering financial instability have not materialized. Systemic risks to global banking and nonbank financial markets appear contained.

That said, regulatory trends are clearly moving toward stricter bank capital and liquidity requirements. Banks’ inability to provide balance sheet capacity in certain markets will likely further push many lending activities to private capital.

We see a growing window for investors to step in as senior lenders in areas once occupied by regional banks, such as consumer lending, mortgage lending, and equipment finance. CRE will also present opportunities for flexible capital, as bank retrenchment exacerbates challenges posed by declining real estate prices and a more than $2 trillion wall of maturing loansFootnote1 over the coming years.

… But fiscal space is constrained

While the monetary policy backdrop has improved, the fiscal outlook has not. The global fiscal trajectory was a focus of this year’s Secular Forum, especially the path of U.S. federal debt.

It remains to be seen whether cyclical U.S. economic strength is durable or merely fueled by pandemic-period government support and a rising debt-to-GDP ratio. If the U.S. eventually faces a fiscal reckoning, debt consolidation through entitlement spending reforms and higher taxes is likely. However improbable it seems in the current political environment, even the seemingly untouchable may have to evolve.

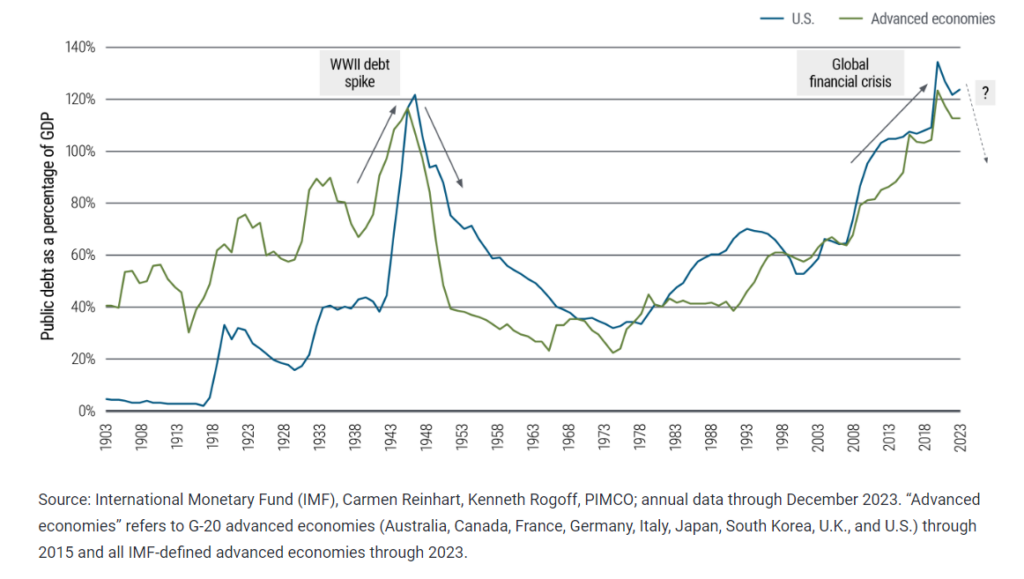

The massive stock of sovereign debt relative to GDP hanging over advanced economies (see Figure 1) will likely cause yield curves to steepen over our secular horizon, as investors continue to demand more compensation on longer-term bonds. There is evidence – for example, forward inflation-indexed yields or estimates of the Treasury term premium – to suggest that markets have already priced in some of this adjustment, even before central banks start to cut rates (to learn more, see our recent piece, “Will the True Treasury Term Premium Please Stand Up?”).

Figure 1: Fiscal space likely to be limited

Authorities will almost surely face more constraints when looking to discretionary fiscal policy to limit the damage from future business cycle downturns. Our baseline is not a sudden financial crisis, but recurring episodes of market volatility when focus shifts to fiscal issues.

Despite these fiscal pressures, we believe that the U.S. dollar will remain the dominant global currency, in no small part due to the lack of a viable challenger. A U.S debt reckoning could eventually come about, but it’s not likely imminent given U.S. advantages in immigration, productivity, and innovation; U.S. Treasuries being a global reserve asset; and the general dynamism of the U.S. economy. An elevated demand for U.S. Treasury securities as a “safe haven,” liquid store of value has, to date, limited the bond market’s concerns about fiscal sustainability. That suggests the timeline for fiscal reforms may be super-secular.

The U.S. may still be the “cleanest dirty shirt” compared with other economies. China’s outlook is challenged by property sector recession, an aging population, and less-open export markets. In Europe, fragmented politics will make it difficult to build a comprehensive growth strategy in the face of regional conflict, energy insecurity, and more direct competition from China on higher-value manufactured goods.

Moving to a multipolar world

The geopolitical landscape is increasingly defined by tensions between a dominant superpower (the U.S.) and its rising rival (China). Both China and Russia have clear long-term visions that are at odds with Western ideals. The peace dividend realized over the past three decades is becoming a conflict outlay.

This underscores a shift toward a multipolar world order, where cooperation seems limited and new middle powers may emerge. The shift will likely also lead to changing correlations across markets and increased divergence in potential growth and policy responses. Business cycles will likely also be less synchronized. We expect the underlying forces will lead to greater macroeconomic and financial market volatility than pre-pandemic.

Risks to financial stability have also increased and could become problematic should these conflicts begin to materially alter cross-border financial flows or create conditions for capital impairments. We believe the risk premium for credit investment in China is too low to be attractive given potential risks.

We expect China’s growth to continue slowing without stalling. Notably, China is re-globalizing. Its new growth model, focused on production and infrastructure to counterbalance a property sector collapse, is driving a rise in manufacturing exports. This pivot requires reevaluating China’s role in the global economy, especially its impact on commodity markets and inflation, as well as its integration into the global financial order.

Major emerging markets (EM) have displayed remarkable resilience this cycle. The typical combination of factors that often trigger EM crises – capital flight, tighter financial conditions, and a collapse in commodity prices – is not currently evident, nor does it appear likely to emerge over the secular horizon. Debt levels in EM countries are increasing but so far remain at sustainable levels compared with DM.

Roughly 60% of the world by GDP weight will be voting in a major election this year. With early signs of populist parties gaining support – particularly in Europe – global elections have scope to change both economic and geopolitical policy priorities. We see risks that elections increase trends toward fragmentation, multipolarity, and protectionist measures, favoring friend-shoring investments. Countries such as India, Indonesia, and Mexico are positioned to benefit.

Turning to the U.S. presidential election, we believe trade, tax policy, immigration, regulation, and environmental policy have the greatest scope for disruption. U.S. fiscal deficits are likely to remain near historic highs regardless of the election outcome. Both political parties are also focused on remaining tough on China.

AI effects coming into focus

Generative AI has the potential to transform labor markets and democratize access to decision-making tasks, enabling more of the workforce to make informed decisions.

But many organizations will face challenges as they seek to leverage AI effectively. Dramatically enhanced productivity and efficiency may not be evident in the macro data over the next five years. This is because maximizing the payoff from AI at the macro level will require not only adoption of the technology itself, but also the reconfiguration of work streams and the rethinking of production processes at the micro level of individual organizations.

Similar to the experience with other new technologies over the past few decades, there may not be much of an incremental impact on productivity from modest enhancements of existing work practices. But there is a chance of breakthrough changes that could have a larger impact on productivity growth in certain specific areas, such as healthcare and science.

While our base case is that the full impact of new AI large language models manifests gradually over the secular horizon, it’s possible that disruptions may occur more quickly. The capital spending boom in computing, data centers, and green energy technology increases availability of these resources for applications beyond AI, while AI investment makes AI-supported breakthroughs in other fields increasingly plausible. Downside surprises are possible as well, especially if misuse of AI models for surveillance, manipulation, or security threats results in innovation-stifling restrictions.

For now, capital spending can lead to a shorter-term sugar high. Ultimately, efficiency gains will be needed to generate longer-term sustainable growth.

The demand for chips, data centers, and the generation capacity that will power them is expected to be explosive, and these trends will have immediate sectoral consequences.

Neutral policy rates to remain low

Today’s elevated policy rates are the result of cyclical forces, namely an inflationary spike. Once inflation stabilizes near central bank targets, we expect neutral monetary policy rates in advanced economies will likely settle at levels below those that prevailed before the global financial crisis.

We believe the neutral nominal policy rate in the U.S. over our secular horizon will likely remain in the range of 2%–3% (implying a long-run neutral real rate of 0%–1%). By contrast, current pricing indicates markets expect the neutral rate may not fall far below 4%. That can present further opportunities for bond investors, as yields today already embed cushion in the form of positive real rates and term premium.

We expect central bank balance sheets, which are currently contracting under quantitative tightening (QT) programs, will remain substantially larger than before the era of quantitative easing (QE). DM central banks will likely continue to use asset purchase programs to ensure the smooth functioning of sovereign debt and repurchase markets, and to act as lenders of last resort. Examples include the U.S. Federal Reserve’s 2023 Bank Term Funding Program and the Bank of England’s 2022 operation to support the U.K. gilt market.

However, we think it is less likely that central banks deploy open-ended QE asset purchase programs in response to future economic downturns. The financial strain of maintaining large securities portfolios, where the costs of funding exceed the returns from these assets, has become increasingly apparent.

Monetary and fiscal puts – or expectations of government relief in the event of downturns – are further out of the money today. That constrains the government’s ability to stimulate flagging economies and provide support to dampen shocks. We expect additional volatility as markets trade more on fundamentals and less on the expectation that governments will come to the rescue.

Investment implications: Fixed income resurgence

Our 2024 Secular Outlook favors a renewed focus on public fixed income markets, which we believe are poised to generate competitive returns and lower risk compared with other asset classes. Today’s yields and a stabilizing inflation outlook are enabling bonds to reassert their fundamental advantages in portfolios: providing potential for attractive income, downside resilience, and stability through reduced correlation with equities.

Many sophisticated asset allocators have moved well beyond the traditional 60% stocks / 40% bonds paradigm. Even so, it remains an oft-cited rule of thumb that frames many investment conversations. We believe we are entering an era that warrants a rethinking and a reversal of that concept.

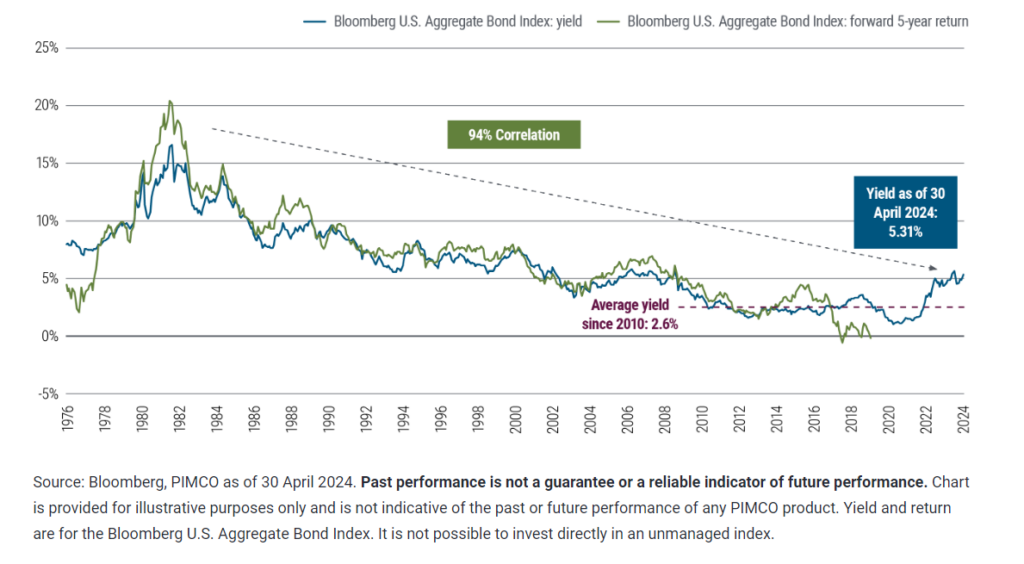

The post-pandemic inflation shock and subsequent central bank rate-hiking cycle reset bond yields sharply higher. Historically, starting yields are highly predictive of bond returns over a multiyear horizon (see Figure 2). The yields on the Bloomberg U.S. Aggregate and Global Aggregate (hedged to U.S. dollar) Indexes, two common benchmarks for high quality bonds, are about 5.31% and 5.41%, respectively, as of 30 April 2024.

Figure 2: Starting yields in bond markets historically correlated with 5-year forward returns

Using that as a baseline, active investment managers can seek to enhance the yields investors earn. By identifying attractive opportunities in high quality areas – such as agency mortgage-backed securities – active managers can currently construct portfolios yielding about 6%–7% without taking on significant interest rate, credit, or illiquidity risk.

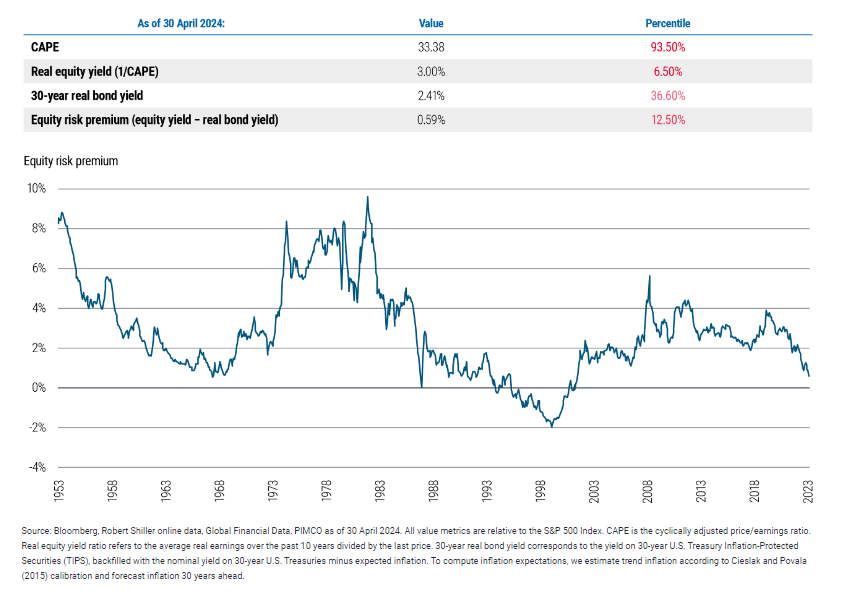

As a result, a diversified bond allocation offers the potential for long-term equity-like returns with a more favorable risk-adjusted profile, especially given what may be stretched valuations in stock markets (see Figure 3). Markets don’t appear to price significant recession risk, meaning bonds may be an inexpensive means to hedge that risk.

Figure 3: Equities screen expensive on an absolute basis and relative to U.S. Treasuries

Bonds today also embed a term premium that offers a cushion. We expect yield curves to steepen as policy rates decline and the term premium builds (for more, read our February PIMCO Perspectives, “Back to the Future: Term Premium Poised to Rise Again, With Widespread Asset-Price Implications”), and we have a curve steepener as a structural trade.

In the wake of its longest-ever inversion, the U.S. yield curve remains relatively flat. That means investors do not need to take a lot of interest rate risk. We currently find value at the 5-year part of the yield curve and are wary of potential underperformance of the long end due to fiscal concerns. Active fixed income is positioned to perform well if there are no recessions over our secular horizon and to perform even better if there are, with the potential for price appreciation if yields decline, which makes bonds attractive compared with cash, in our view.

Global bond markets offer particularly attractive and diverse opportunities that investors might be overlooking as a way to enhance yield without significantly increasing risk. Global yields – across DM and EM – have returned to attractive levels. Many economies outside of the U.S. face more fragility yet enjoy better starting fiscal conditions, both supportive of bonds.

We expect business cycles will be less synchronized, which will lead to lower correlations across financial markets. The differentiation in central bank policies and market conditions across regions presents unique opportunities for active, global investment platforms to capitalize on these discrepancies and potentially further enhance returns through country and security selection. Industrial subsidies and trade policies promoting onshoring, friend-shoring, and the energy transition will likely create both sectoral and national winners and losers, presenting further opportunities for active investors.

Given potential volatility around inflation, U.S. Treasury Inflation-Protected Securities (TIPS), commodities, and real assets offer inflation-hedging properties and higher real rates than pre-pandemic levels.

Prioritize credit selection and liquidity

While credit spreads appear broadly fair overall, credit and sector selection are poised to become more important over our secular horizon. Growth in both public and private credit markets should give active investors with flexible capital more opportunities during periods of volatility.

Many stronger, more resilient companies generate significant cash and don’t rely heavily on financing. Many weaker companies tend to need greater ongoing access to credit. The more productivity-enhancing AI technologies are, the more disruptive they are likely to be across companies and industries, creating more winners and losers. In the past, the advent of new technologies has often been followed by boom-bust cycles, creating volatility but also presenting bottom-up active investment opportunities.

We expect increased regulation for banks, which should lead to more disintermediation and more money flowing through private markets. Our focus remains on liquidity gaps arising from banks being pressured to manage capital and meet regulatory requirements. For example, this bank retrenchment will likely create opportunities for flexible capital in CRE debt, as we expect large-scale capital needs for asset owners facing a wall of loan maturities.

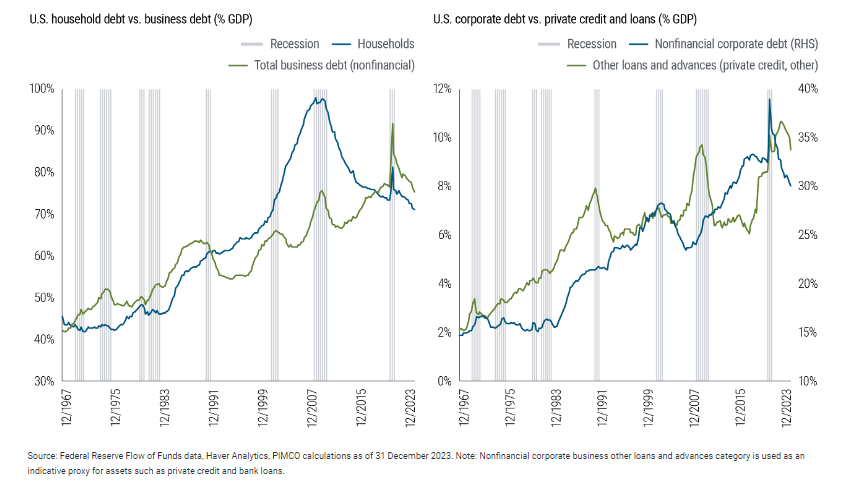

Asset-based lending is a prime example of what we see as an attractive and less crowded investment opportunity. Middle-market corporate lending appears to be in favor within private markets, but we believe areas such as consumer lending offer outstanding long-term fundamentals and value as U.S. household leverage has declined (see Figure 4) and housing markets remain well-supported.

Figure 4: Household debt has declined, while private corporate lending has grown

We would contrast that with the amount of capital now concentrated in corporate lending. We are very concerned about the rapid growth within private, floating-rate markets that may not have been tested through prior default cycles. These conditions increase the risk of excesses building in areas such as technology and direct lending to companies with high leverage and lower credit ratings. Challenges could emerge during our secular time frame.

Given the high potential for returns in the more liquid segments of the bond market, investors should have a high hurdle – in the form of attractive return potential and strong lender covenants – for giving up liquidity. At today’s yield levels, the risk-adjusted return potential of broadening exposure to public fixed income markets – such as increasing allocations to high quality DM and EM bonds – also compares favorably with the trade-offs involved in extending into less liquid areas of credit markets.

1 According to Newmark Research calculations, as of 12 February 2024

Key Takeaways From PIMCO’s Sustainable Investing Report 2023

23/05/2024 PIMCO

PIMCO’s Sustainable Investing Report provides our latest thinking on sustainability. Here, we highlight the report’s key takeaways on engagement, energy transition and carbon analytics.

The sustainable investing landscape is being transformed by several long-term drivers, from evolving global regulation that will continue to have investment implications, to dominant trends like climate transition risks and the unlocking of capital flows to underserved markets. We are also witnessing a compelling convergence of emerging themes – such as nature and biodiversity, climate physical risks, and access to affordable housing. These shifts are creating steadfast investment opportunities such as thematic labeled bonds, transition finance, and private credit strategies, and we are excited by these and other possibilities we see emerging over the secular horizon.

This year PIMCO has focused on expanding our robust platform, deepening our analytical capabilities and diversifying our proprietary frameworks. Consistent with our broader investment platform, our efforts extend beyond traditional areas of fixed income and into alternative asset classes, including private credit, structured products, and real estate. Additionally, we have strengthened our in-depth climate risk and biodiversity analysis, including additional carbon analytics, carbon attribution and projection tools.

All of this we do with our clients in mind. We are committed to helping clients pursue their investing goals and actively engage with them to implement thoughtful solutions that aim to deliver on their objectives.

PIMCO’s “Sustainable Investing Report” offers detailed insights on these developments, along with our latest thinking on market drivers and trends, and detailed case studies on engagement. Here are some highlights from the report.

Environmental and climate research

In 2023, the transition to a lower-carbon economy was marked by both progress and challenges. For example, the renewable energy sector, including offshore wind, faced issues such as high initial valuations, execution problems, supply chain disruptions, and increased funding costs driven by increasing interest rates. Despite these difficulties, the general commitment to green technologies and climate investment remains strong, bolstered by international and regional policy developments.

The transition is unrolling at varying paces across different regions, and there is no one-size-fits-all interpretation and implementation of climate transition plans for an issuer or investor. This is in part why we continuously look at ways to enhance and expand our capabilities to assess and manage climate risks, as well as measure and optimize the climate impacts of portfolios. For example, we have deepened our research on topics like Scope 3 (i.e., upstream and downstream) carbon emissions, carbon reporting outside corporates (e.g., sovereign and securitized products) and climate solutions. The goal is to ensure our frameworks and tools reflect market developments and client needs; and in 2023, the focus broadly shifted among many asset owners from setting portfolio climate targets to implementing them at the portfolio level.

We have developed a proprietary portfolio carbon projection tool to analyze transition risks and decarbonization targets. This tool estimates potential future carbon emissions associated with a portfolio based on various scenarios specifically relevant for fixed income. It considers factors like reinvestments and issuer commitments or their historical emissions. The reinvestment of matured securities, for example, can significantly impact the rate of decarbonization for a portfolio and, if well handled, may create an opportunity to advance a portfolio’s carbon targets while supporting real-economy emissions reductions.

Structured credit and real estate integration

We believe PIMCO’s scale and experience across a range of markets make us well positioned to play a vital role in strategic industry efforts related to sustainable investing. This extends beyond corporate entities, into structured credit, as well as sovereigns, municipals, and alternatives, where applicable. These multifaceted efforts provide a distinctive market perspective that is unique to PIMCO.

Structured products are significant in the fixed income market, making up about 25% of all outstanding securities. PIMCO considers them an essential investment component in supporting clients in their sustainability journeys. They have unique advantages as well as downsides, but the variety within the asset class has allowed our clients to explore investment opportunities that offer either environmental or social benefits.

Over the last year we have continued the development of our proprietary frameworks across multiple asset classes and themes, including expanded Environmental, Social and Governance (ESG) scoring coverage and analysis of structured products including auto-asset backed securities (ABS), collateralized loan obligations (CLO), covered bonds, sovereigns, supranationals, and agencies (SSA).

We also continued building out our real estate platform in 2023. PIMCO invests in a variety of real assets including commercial, residential, and infrastructure investments. In addition to the overarching materiality framework which underpins our alternatives approach, we have developed specific and proprietary tools for broadly assessing material risks which can arise from investing in real assets. This framework includes specialized research and analysis related to physical and transition climate risks, energy usage and efficiency, as well as affordability and access.

Labeled bonds and role of fixed income in sustainable investing

Despite a decrease in absolute issuance of ESG-labeled bonds in 2022 and 2023, the proportion of ESG labels within corporate fixed income indices continues to grow, partly due to a higher rate of traditional bonds exiting these indices. PIMCO applies its fixed income expertise to this area, using tools such as our proprietary relative value tracker to assess the “greenium” or the discount/premium of ESG-labeled bonds compared to traditional bonds.

Recognizing the importance of sustainability-linked bonds (SLB) within the ESG labeled bond universe, we have developed a proprietary SLB tracker. This tool assesses bonds with upcoming Key Performance Indicator (KPI) testing dates on a periodic basis. It is critical for portfolio managers, as a growing portion of outstanding SLBs approach milestones for their sustainability KPIs, potentially triggering coupon step-ups.

However, ESG bonds are only one part of the ESG-investible universe, as many issuers with favorable ESG profiles continue to issue traditional debt, and we will continue to maintain a balanced focus on communication and research for conventional bond investments.

We believe bond investors can play a pivotal role in the sustainable transition of economies and businesses; and we seek to execute our strategies through research, engagement and investment, leveraging the multiple connections between capital providers and issuers. We employ a forward looking, integrated approach to pursue long-term value for our clients.

Download our Sustainable Investing Report here to read more of our views and analysis, as well as our engagement case studies. Visit here to learn more about sustainability at PIMCO.

Kansen in Europese Datacentra

Alternatieven Ontgrendelen

Ontdek waarom Europese datacenters een van onze sterkste overtuigingen is binnen de vastgoedmarkten van vandaag.

Wat zijn datacentra?

Een datacenter is een gebouw dat de fysieke hardwarecomponenten huisvest die de veilige opslag, verwerking en overdracht van grote hoeveelheden digitale gegevens mogelijk maken. Deze componenten omvatten IT-apparatuur, bijvoorbeeld servers en harde schijven, en de apparatuur die de werking ervan faciliteert, bijvoorbeeld generatoren, batterijen, airconditioning en koelunits, brandblussystemen, transformatoren en glasvezelkabels. Datacentra zijn ook inkomstengenererende vastgoedactiva. In plaats van hun eigen datacentra te bouwen om hun opslag- en verwerkingsactiviteiten te huisvesten, vinden technologiebedrijven – zoals cloudserviceproviders met aanzienlijke computer- en opslagbehoeften – het vaak efficiënter om een lease te tekenen met een datacentereigenaar. De eigenaar van het datacenter zal de stroomtoegang en de gebouwinfrastructuur leveren in ruil voor huurinkomsten. In tegenstelling tot andere commerciële vastgoedklassen, wordt de huur voor datacentra bepaald door de hoeveelheid stroom die beschikbaar is voor de huurder, meestal uitgedrukt in euro’s per kilowattuur.

Waarom is de datacentrumruimte een gebied van sterke overtuiging voor PIMCO?

Naar onze mening profiteert het van sterke seculiere krachten binnen de technologiesector.

Bijvoorbeeld, krachten zoals de groei van internetpenetratie, verhoogde connectiviteit en de groeiende data-intensiteit van internetverkeer, hebben geleid tot aanhoudende groei in de hoeveelheid verbruikte data. Dit wordt geschat op een 4-voudige groei van 2018 tot 2023. Een andere drijfveer van de vraag is de migratie van bedrijfs-IT-diensten naar de “cloud”, wat bedrijvenmeestal bereiken door samen te werken met grote cloudserviceproviders zoals Microsoft, Google of Amazon Web Services die hyperscale computing gebruiken om grote hoeveelheden klantgegevens te verwerken.

Deze bedrijven staan bekend als “hyperscalers” en zij verwachten dat hun cloudservice-inkomsten zullen groeien van $41 miljard in 2018 tot $230 miljard in 2023, wat de immense omvang van deze trend aantoont. Deze hyperscalers zijn ook de grootste datacentrumhuurders wereldwijd. Een interessant kenmerk van deze cloudmigratietrend is de potentiële veerkracht tegen recessie.

Cloudservices kunnen klanten meer flexibiliteit en potentiële kostenbesparingen bieden, omdat ze hun capaciteit kunnen op- of afschalen afhankelijk van hun behoeften. Ook kunnen veel bedrijven tijdens een recessie hun IT-uitgaven daadwerkelijk verhogen, omdat ze proberen verschillende processen te automatiseren of efficiënties in het hele bedrijf te creëren. In beide gevallen kan een groter gebruik van cloudservices leiden tot een nog groter inkomstenpotentieel voor de hyperscalers en hun vraag naar datacentrumcapaciteit.

Waarom nu focussen op Europese datacentrummarkten?

In vergelijking met de VS is de datacentrumcapaciteit op capita basis in Europe beperkt, gezien de robuuste wereldwijde vraag.

Zelfs tier 1-markten, die over het algemeen verwijzen naar een groep West-Europese markten waar het overgrote deel van Europa’s datacentrumcapaciteit zich bevindt, namelijk – Frankfurt, Londen, Amsterdam en Parijs, lopen momenteel vijf jaar achter op de VS in termen van geïnstalleerde capaciteit. Tier 2-markten en Tier 3-markten lopen zelfs nog verder achter. In de komende jaren verwachten we convergentie in groeitrends tussen zowel de VS en Europa als binnen Europa om twee primaire redenen. De eerste is de groeiende penetratie van low-latency toepassingen, die lokale dataopslag en -verwerking dichter bij de eindgebruikers vereist. De tweede katalysator voor groei in gelokaliseerde datacentrumcapaciteit in Europa is de opkomst van gegevensbescherming en digitale soevereiniteitsregelgeving.

We zijn het meest enthousiast over de mogelijkheden in tier 2 en tier 3 Europese datacentrummarkten. Hier biedt het gebrek aan bestaande capaciteit aanzienlijke “ruimte” om datacentra te bouwen en dit te doen met de huidige ontwikkelingseconomieën die materieel aantrekkelijker zijn dan wat kan worden bereikt voor datacentra in tier 1-markten, of voor andere vastgoedsectoren.

Voor meer informatie, bezoek nl.pimco.com

IMPORTANT NOTICE

Please note that the following contains the opinions of the manager as of the date noted and may not have been updated to reflect real time market developments. All opinions are subject to change without notice.

This material (the “Material”) is being provided for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy interests in a fund or any other PIMCO trading strategy or investment product.

The investment strategies discussed herein are speculative and involve a high degree of risk, including a loss of some or all capital. Investments in any strategies described herein may be volatile, and investors should have the financial ability and be willing to accept such risks.

The issuers referenced are examples of issuers PIMCO considers to be well known and that may fall into the stated sectors. References to specific issuers are not intended and should not be interpreted as recommendations to purchase, sell or hold securities of those issuers. PIMCO products and strategies may or may not include the securities of the issuers referenced and, if such securities are included, no representation is being made that such securities will continue to be included.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Certain information contained herein concerning economic trends and/or data is based on or derived from information provided by independent third-party sources. PIMCO believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Forward looking statements (including opinions or expectations about any future event) contained herein are based on a variety of estimates and assumptions by PIMCO. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive and financial risks that are outside of PIMCO’s control.

A word about risk: Investments in commercial real estate debt are subject to risks that include prepayment, delinquency, foreclosure, risks of loss, servicing risks and adverse regulatory developments. Private credit involves an investment in non-publically traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Investments in Private Credit may also be subject to real estate-related risks, which include new regulatory or legislative developments, the attractiveness and location of properties, the financial condition of tenants, potential liability under environmental and other laws, as well as natural disasters and other factors beyond a manager’s control. Equity investments may decline in value due to both real and perceived general market, economic and industry conditions, while debt investments are subject to credit, interest rate and other risks. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Structured products such as collateralized debt obligations are also highly complex instruments, typically involving a high degree of risk; use of these instruments may involve derivative instruments that could lose more than the principal amount invested. Investing in banks and related entities is a highly complex field subject to extensive regulation, and investments in such entities or other operating companies may give rise to control person liability and other risks. The current regulatory climate is uncertain and rapidly evolving, and future developments could adversely affect the sector.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. The material contains statements of opinion and belief. Any views expressed herein are those of PIMCO as of the date indicated, are based on information available to PIMCO as of such date. Statements of opinion are subject to change, without notice, based on market and other conditions. No representation is made or assurance given that such views are correct. PIMCO has no duty or obligation to update the information contained herein.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. PIMCO Europe Ltd (Company No. 2604517) is authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963), PIMCO Europe GmbH Irish Branch (Company No. 909462), PIMCO Europe GmbH UK Branch (Company No. 2604517) and PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch and Spanish Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority; and (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication.| No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.

CMR2022-0728-2319367