Seeing Further across global travel

Global Equity insights from The Future Quality Finders

By Iain Fulton, Nikko AM Global Equity Portfolio Manager , 13 May 2024

This article is part of our new Global Equity Investment Guide, click here to download it.

Key Takeaways

- International tourism is on track to return to pre-pandemic levels in 2024, driven by the reemergence of the Chinese traveller, a new travel cohort stemming from developing nations and artificial intelligence.

- Constrained supply may not be able to keep up with growing demand, creating pricing power.

- Taking our Future Quality lens to the travel industry, we share some example companies well-postioned to benefit from the positive tailwinds in global travel.

Travel and holidays are important to many people as they represent a break from the norm, a chance to escape mundane reality and experience something exciting and possibly exotic. They are a chance to reconnect with family and friends away from the stresses of daily life and can provide significant benefits for our physical, mental and emotional health.

The forced lockdowns imposed during the pandemic era reinforced the value of holidays for many of us, and in our view there has been a meaningful shift toward experiences that cuts across generations. So much so that in a time when the cost of living has risen dramatically, rather than cutting back on holidays people continue prioritising their importance.

Having normalised significantly during 2023, international tourism is well on track to return to pre-pandemic levels in 2024 1, underlining why we feel this ongoing Future Quality investment trend is still worth pursuing.

Successful recovery of global travel

For the last couple of years, the global travel industry has been going through the process of normalisation following the pandemic-imposed restrictions that brought worldwide travel to a halt. Planes were grounded,

accommodation closed and staff were laid off or siloed; consequently, the sector’s recovery has taken time to rebuild to its former scale. This normalisation has taken place against a backdrop of strong consumer demand. As lockdown restrictions were lifted, many consumers were eager to rebook holidays that had been either cancelled or postponed. The unleashing of this pent-up demand meant that, according to the UNWTO World Tourism Barometer, international tourism reached 88% of pre-pandemic levels in 20232.

As investors, we were quick to spot the investment opportunity that the normalisation of travel would represent. But now the recovery appears to be almost complete, it is time to reconsider the ongoing strength of this investment theme.

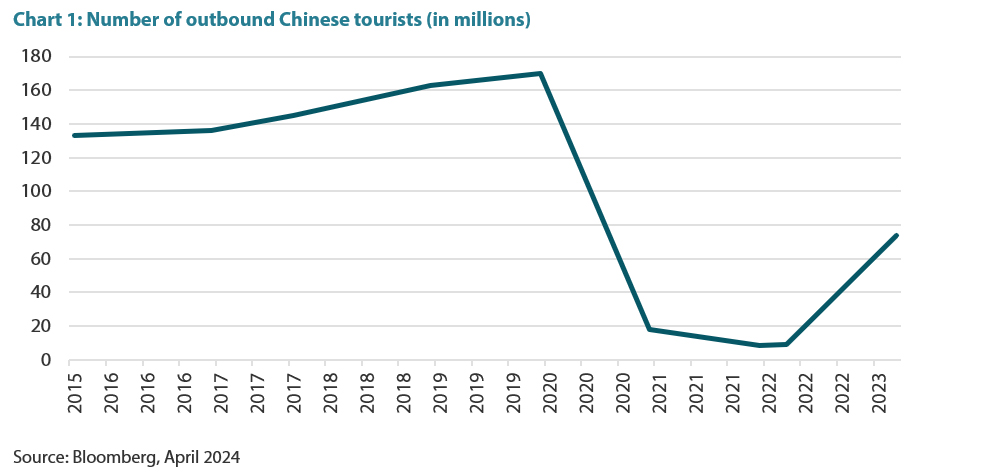

Ongoing growth drivers Our analysis has determined that there remain several key ongoing drivers of growth for the travel industry. Firstly, while the market expectation that demand has now normalised seems fair, we found that one key factor is largely being ignored: the re-emergence of the Chinese outbound traveller. Covid-19 lockdowns were in place for a lot longer in China than anywhere else in the world and therefore travel restrictions have only just been fully lifted. Given the significant size of the Chinese population, the process of restoring the operational outbound capacity for flights will take time to reach its former scale and demand was initially subdued amid lingering concerns over Covid-19 and tepid economic growth. Yet, the importance of Chinese travellers should not be underestimated. In 2019, they represented the world’s largest share of outbound tourists, contributing around USD 250 billion to the global economy 3. Signs are positive that Chinese travel will rebound this year with domestic trips over the China Lunar New Year holidays increasing 34% compared with 2023 and marking a 19% rise on 2019 levels 4. Travel and tourism have also been highlighted as the best-performing elements of China’s otherwise lacklustre economy.

Secondly, a new travel cohort is emerging from developing countries – India as a prime example – where rising gross domestic product per capita means more people will be able to afford to travel in the future. While this also includes China, it particularly encompasses the wider Asian region and has resulted in UK airport Heathrow increasing its forecasts of passenger numbers this year due to the growth in Asian routes 5.

Finally, artificial intelligence (AI) is being embraced by the travel industry initially to enhance the booking experience for flights, accommodation and car hire, as well as boosting call centre efficiency. However, going forward, AI applications could encompass advertising strategy, marketing content and greater personalisation.

Another factor to consider is supply and demand, given that the demand is clearly there it would be expected that at this stage of the cycle new accommodation would be being developed at an aggressive rate. However, due to concerns around commercial real estate and higher borrowing costs that supply growth is not coming through, and is creating further inflationary pressures on overall holiday prices.

Future Quality Finders

Having discussed and reviewed our investment thesis around global travel, we still need to apply our Future Quality lens to find the companies that will attain and sustain rewarding returns not only today but more importantly for tomorrow.

In our view, many quality companies are directly benefitting from the positive tailwinds in global travel, from booking companies to manufacturers of luggage and travel accessories. We currently favour Booking.com, Amadeus and Samsonite.

Focusing on luggage manufacturer Samsonite, having re-engineered its manufacturing footprint and streamlined its costs during the pandemic, we felt its management did a good job of positioning the company for more profitable growth in the future with brand equity and pricing power largely intact. We expect the ongoing recovery in travel, particularly among business travellers, will continue to drive revenue growth and, with a lower fixed cost structure, the business has the opportunity to earn margins somewhat higher than the traditional norm.

By seeing further and envisioning the investment opportunities of tomorrow, we aim to invest in not only what is, but what will be. Contrary to popular perceptions, we anticipate that global travel will endure as a long-haul investment journey that avoids any significant turbulence.

For more information on our global equity investment process, please download Nikko AM’s new investment guide: Seeing Further in Changing Times.

If you have any questions on this report, please contact:

Nikko AM team in Europe

Email: EMEAenquiries@nikkoam.com

Biodiversity is next for green bond expansion

By the Nikko AM Green Bond Team, 1 November 2023

Climate change is not the only environmental threat to how we live, work and interact with our planet. Our economic system is based on a model of take, make and waste that consistently over-utilises and fails to replenish Earth’s valuable, but dwindling resources. This is best depicted by Earth Overshoot Day, the annual date when humanity’s demand for ecological resources and services exceeds what Earth can regenerate in that year.[1] In 2023, this fell on 2 August and has been occurring earlier each year.

The climate change megatrend

By the Nikko AM Green Bond Team, 25 October 2023

“The era of global warming has ended; the era of global boiling has arrived.” Those were the words of United Nations Secretary-General António Guterres in a recent speech at the UN headquarters in New York City. And it has certainly been a chastening few years in terms of weather extremes, including wildfires, hurricanes and record-breaking heatwaves in Europe, Asia and North America. Formerly once-in-a-generation exceptional events now risk becoming alarmingly routine.

Important information:

This document is prepared by Nikko Asset Management Co., Ltd. and/or its affiliates (Nikko AM) and is for distribution only under such circumstances as may be permitted by applicable laws. This document does not constitute personal investment advice or a personal recommendation and it does not consider in any way the objectives, financial situation or needs of any recipients. All recipients are recommended to consult with their independent tax, financial and legal advisers prior to any investment.

This document is for information purposes only and is not intended to be an offer, or a solicitation of an offer, to buy or sell any investments or participate in any trading strategy. Moreover, the information in this document will not affect Nikko AM’s investment strategy in any way. The information and opinions in this document have been derived from or reached from sources believed in good faith to be reliable but have not been independently verified. Nikko AM makes no guarantee, representation or warranty, express or implied, and accepts no responsibility or liability for the accuracy or completeness of this document. No reliance should be placed on any assumptions, forecasts, projections, estimates or prospects contained within this document. This document should not be regarded by recipients as a substitute for the exercise of their own judgment. Opinions stated in this document may change without notice.

In any investment, past performance is neither an indication nor guarantee of future performance and a loss of capital may occur. Estimates of future performance are based on assumptions that may not be realised. Investors should be able to withstand the loss of any principal investment. The mention of individual securities, sectors, regions or countries within this document does not imply a recommendation to buy or sell.

Nikko AM accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this document, provided that nothing herein excludes or restricts any liability of Nikko AM under applicable regulatory rules or requirements.

All information contained in this document is solely for the attention and use of the intended recipients. Any use beyond that intended by Nikko AM is strictly prohibited.

United Kingdom: This document is communicated by Nikko Asset Management Europe Ltd, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority (the FCA) (FRN 122084). This document constitutes a financial promotion for the purposes of the Financial Services and Markets Act 2000 (as amended) (FSMA) and the rules of the FCA in the United Kingdom, and is directed at professional clients as defined in the FCA Handbook of Rules and Guidance.

Luxembourg and Germany: This document is communicated by Nikko Asset Management Luxembourg S.A., which is authorised and regulated in the Grand Duchy of Luxembourg by the Commission de Surveillance du Secteur Financier (the CSSF) as a management company authorised under Chapter 15 of the Law of 17 December 2010 (No S00000717) and as an alternative investment fund manager according to the Law of 12 July 2013 (No. A00002630).