10 trends driving the global data center market

The data center market is experiencing rapid growth. Here are 10 trends propelling the data center economy and the reasons we believe investors should consider including them in their portfolios.

1. AI is driving enormous increases in demand—and massive densification

Artificial intelligence (AI) workloads, such as machine learning and natural language processing, are exceptionally computationally intensive. Training sophisticated AI models like GPT-4 can require thousands of specialized processors running for weeks. As AI proliferates across industries, the need for infrastructure to support these workloads is skyrocketing.

2. Cloud keeps growing, too

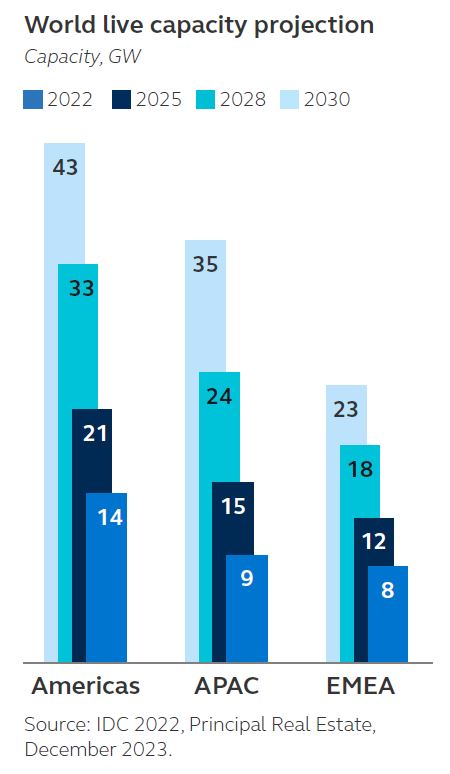

Demand for data centers to support AI is additive to demand for data centers to support traditional and cloud workloads, which continue to grow rapidly as enterprises migrate an ever-growing portion of their IT workloads. Spending on cloud infrastructure is projected to reach $156.7 billion by 2027, according to IDC—over a third of total compute and storage infrastructure spend1.

3. Cloud providers are building new availability zones

To meet rising demand, cloud providers are aggressively expanding their global footprints—including by launching new cloud regions and availability zones (AZs) where they’ve outgrown existing regions and zones. (A cloud region has one or more availability zones within it, and an availability zone has one or more data centers.)

4. Meeting new demand requires a huge amount of capital, which is now more expensive

Meeting the staggering demand for data center capacity will require massive capital investment. Data centers are getting bigger, on average, and can now cost upwards of a billion dollars. While traditional models like self-funding and debt financing remain important, more data center operators are turning to unique strategies to fund projects—including portfolio pruning, forward sales, joint ventures, and sale leasebacks.

5. Operators are kicking their sustainability efforts into high gear

Sustainability is a key corporate priority, as companies recognize the importance of reducing their environmental footprint to mitigate climate change, manage risk, meet customer expectations, and attract investors. Across industries, companies are taking steps to improve their sustainability, including by setting science-based emissions reduction targets, investing in renewable energy, and working to reduce carbon impact across their supply chains.

Accordingly, data centers operators are implementing a range of measures to minimize their environmental impact—from deploying energy- and water-efficient equipment to using AI-powered tools to optimize resource consumption.

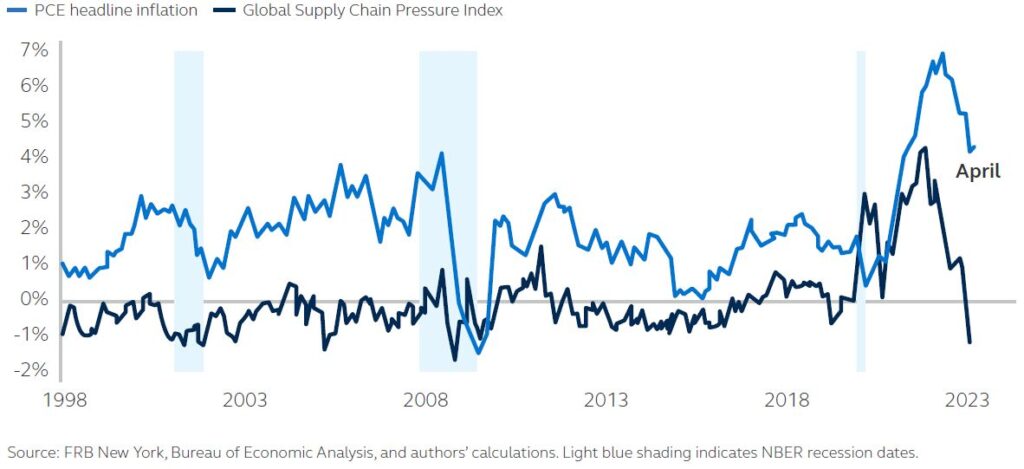

6. Supply chain constraints are easing …

Manufacturing and transportation bottlenecks arising from COVID-19—exacerbated by exponentially rising demand—caused data center supply chain timelines to balloon. The industry average lead time for generators, as just one example, spiked from 20-30 weeks to 72-104+ weeks. In general, supply chain constraints are easing, as manufacturers and logistics providers work through backlogs and ramp up capacity to meet rising demand.

7. … but power is increasingly constrained

In both the U.S. and Europe, while supply chain constraints have eased, power constraints have worsened as demand from the data center sector and other sectors grows more rapidly than utilities can keep up with. In many markets, it can take years to get power utility interconnection at a data center site. In Northern Virginia, the world’s largest data center hub, developers face a multi-year backlog for new electricity connections. In Dublin, new data center development has been stymied by power shortages. Overcoming these challenges requires close collaboration between data center operators, utilities, and policymakers.

8. Souring public sentiment has made it more difficult to get approval to build

Public perception is becoming an increasingly important factor in data center development, as communities grapple with the rapid growth of digital infrastructure in their midst. Concerns about data centers’ impact on local resources and quality of life have led to tensions between developers and residents and officials. Fears about noise, water usage, and strains on the power grid are causing some communities to view data centers as more of a burden than a benefit.

Developers must increasingly engage with local stakeholders and emphasize the economic and social benefits of data centers to build support. Addressing public concerns and building trust will be essential for the long-term success of the data center industry.

9. Data center operators are looking to new power and cooling technologies

Driven by sustainability considerations, public perception, and power constraints, developers are exploring new power technologies. On-site generation and storage could mitigate power constraints—and also improve sustainability (if generation is carbon-free). On-site nuclear generation via small modular reactors (SMRs) is gaining interest, though in many communities it would likely generate even more public backlash and regulatory scrutiny than developers already face.

Developers are also implementing new cooling technologies. Specifically, liquid cooling will soon be a prerequisite for handling the extreme heat densities of AI and other advanced workloads.

10. Data center operators are designing to meet today’s needs—and tomorrow’s

The nine trends described here are changing how data centers are sited, designed, developed, and operated. But they’re not rendering existing facilities obsolete, and operators will have to continue to support the workloads of yesterday alongside the workloads of today and tomorrow.

Given the highly specialized and niche nature of the data center industry, we believe experience and access are critical to successful execution. As an active commercial real estate investor for more than 60 years2—including more than 17+ years in the data center sector—we have witnessed the asset class evolve and adapt to the changing needs of occupiers.

To find out more:

Visit our website.

Contact our sales team:

Stef Bogaars (bogaars.stef@principal.com) or Britt Laeven (laeven.britt@principal.com)

1 Source: IDC, Cloud Infrastructure Spending Continued to Grow in the Second Quarter of 2023 Led by Spending on Shared Cloud Infrastructure, October 2023

2 Principal Real Estate Investors became registered with the SEC in November 1999. Activities noted prior to this date were conducted beginning with the real estate investment management area of Principal Life Insurance Company and, later, Principal Capital Real Estate Investors, LLC, the predecessor of Principal Global Investors Real Estate.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return.

Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.